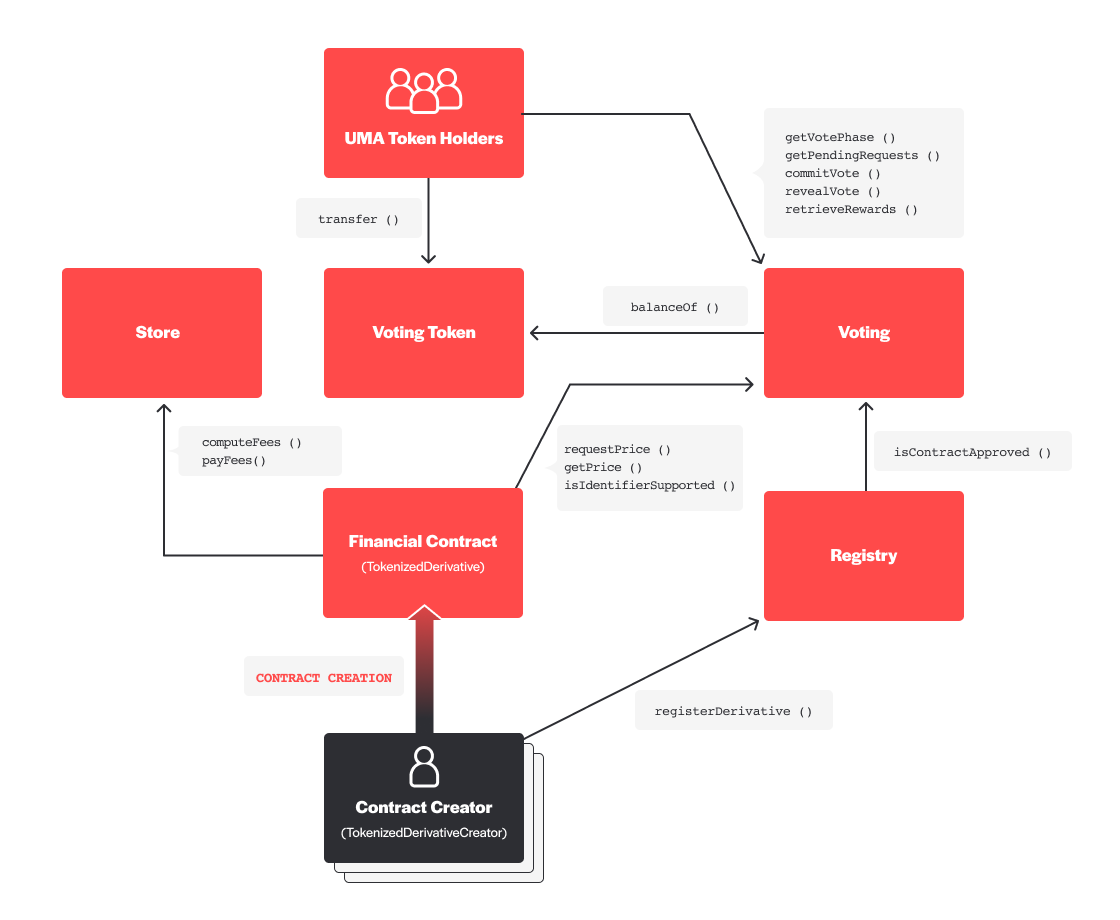

Technical Architecture of the DVM

This document explains the general architecture of UMA's DVM (Oracle). It is meant to be a high level overview and is by no means an exhaustive explanation of the system.

Purpose#

The purpose of the DVM is to provide prices for assets. The DVM provides these prices to financial contracts, which are smart contracts that need an asset price and have some amount of money that depends on that price.

VotingToken#

The VotingToken is a simple ERC20 contract whose ownership allows a voter to respond to price requests.

Voting#

The DVM is powered by voters. Each price request from a financial contract must be voted on. The relative weighting of votes is determined by how many VoteTokens each participant holds.

The Voting contract maintains a whitelist of identifiers (price feeds) that financial contracts can request prices for. This list is currently controlled by voters.

After a request is received, a voting period begins. Voters follow a typical commit-reveal cycle to provide their votes to the Voting contract.

After the vote period ends, the contract rewards the voters who voted with the majority by minting them new tokens proportionally to their vote share. Voters who did not vote or voted incorrectly do not receive newly minted tokens.

Financial Contracts#

Financial contracts make price requests to the Voting contract when they need a price input. Once that price request

has been resolved, they call getPrice() to retrieve the price that was returned.

To pay for the DVM service, financial contracts must pay fees to the Store contract. The Store has methods that take fees and methods that allow contracts to compute the required payment. There are two types of fees:

Regular Fee: a periodic fee that's based on the amount of money the contract is holding.

Final Fee: a flat fee that's paid on every price request.

Contracts are expected to honestly pay their fees. To enforce this, the Voting contract only accepts price requests from approved contract types.

Contract Creators#

To deploy an approved contract type, one must deploy it through an approved contract creator. Contract creators are small, shell contracts whose job is only to deploy financial contracts. If a contract creator is approved, it means that it has been reviewed to ensure that all contracts that it can deploy will pay their fees honestly.

When a contract creator deploys a new financial contract, it registers it with the Registry contract to signal its approval.

Registry#

The Voting contract uses the Registry to validate whether a financial contract should be allowed to make a price request.

The Registry maintains two lists:

Approved contract creators: these contracts have permission to register new financial contracts in the Registry.

Approved financial contracts: these contracts have been registered by an approved contract creator and are allowed to make price requests to the Voting contract.

Store#

The Store contract helps contracts compute their fees and collects those fees from contracts. The Store's funds are to be used to buy back and burn tokens. Right now, the funds can be withdrawn by the contract admin to do this offchain. In the future, this buyback may be accomplished on-chain as a part of the contract logic.