Success Tokens Summary

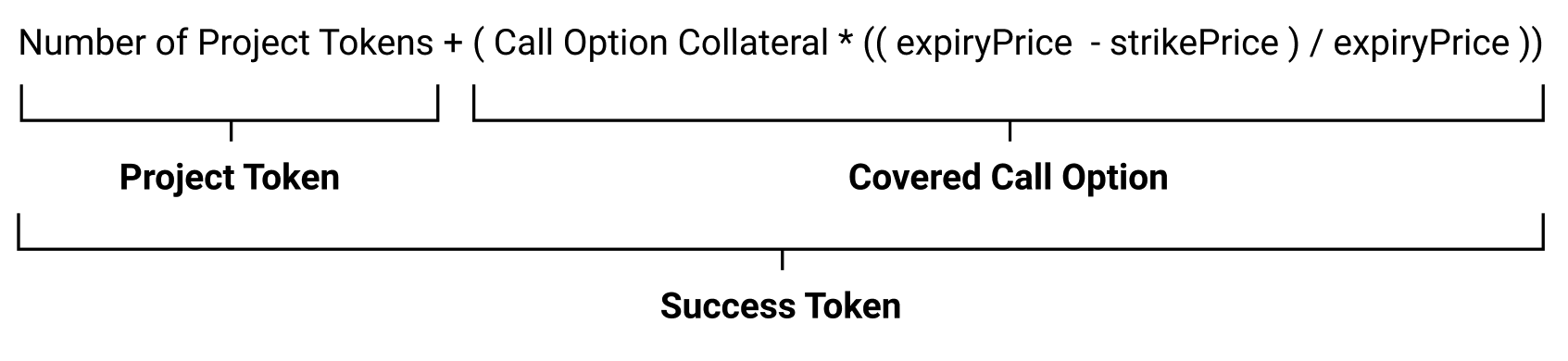

Success tokens offer an alternative way for DAOs to diversify their treasury and sell tokens to investors in an incentive-aligned way. Success tokens are just two financial products wrapped into one token: a set amount of a project token which is combined with a covered call option on that token backed by a set amount of the same token.

Success Token Parameters#

Before contract deployment, the following parameters should be negotiated between a DAO and investors:

- The strike price of the call option.

- The expiry date.

- The price at which the success token is sold.

- The units of collateral that should be used as the floor value per success token. In the graphic below, this is referenced as

Number of Project Tokens. - The units of collateral backing each covered call option per success token. In the graphic, this is referenced as

Call Option Collateral.

The success token payout calculation uses these parameters to determine the following payout at expiry:

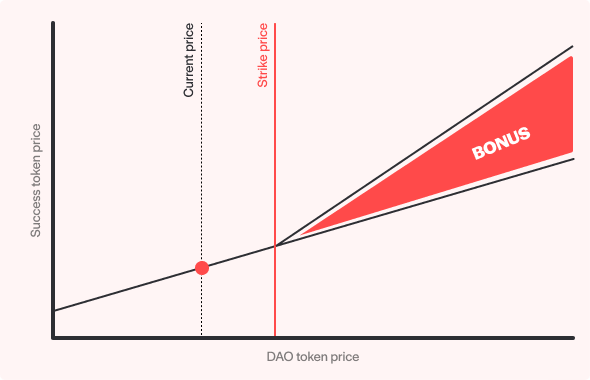

If the expiration price is below the strike price, the investor only receives the project token portion and does not receive any portion of the collateral backing the covered call option. If the expiration price is above the strike price, the call option pays investors an additional amount demonstrated as the bonus value below:

Note on Success Token Parameters#

On-chain, Number of Project Tokens and Call Option Collateral are actually determined by two other parameters. These are called collateralPerPair and basePercentage. collateralPerPair is simply the total units of collateral backing one success token. basePercentage determines the percentage of the total success token collateral (collateralPerPair) that is used as the floor value for the success token versus the percentage that is used to collateralize the covered call option.

As an example, a success token with a collateralPerPair of 2 and a basePercentage of 0.75 would have a floor value of 1.5 units of collateral combined with a covered call option backed by 0.5 units of collateral.

Success Token Example#

An example contract we will refer to throughout the success token sections is a success token issued by the UMA treasury (stUMA-1221) with several VC investors that agree to create a success token which combines 1 $UMA token with a $15 strike $UMA call option backed by 0.5 $UMA tokens.

The value of the success token would depend on the UMAUSD price at expiry:

- If the price is less than $15, each long is worth 1 $UMA, because the embedded call option expired worthless.

- If the price expired at $30, the success token value in UMA would be calculated using 1 + (( 0.5 ) * ( $30 - $15 ) / $30 ) = 1.25 $UMA per success token. In dollar value, 1 stUMA-1221 with a $30 expiry price would be worth $30.00 * 1.25 = $37.50.

Why Should an Investor Buy a Success Token?#

- Success tokens provide investors the kind of risk and upside exposure potential they are looking for without forcing a project or DAO to sell tokens at a discount. Investors are receiving compensation for capital lock-up time in the form of a call option instead of a token discount. This provides a strong incentive for investors to participate in the project's growth, while also giving the investor a large amount of upside. This is a mutually beneficial situation for both parties involved, where the investor is only specially compensated if the project succeeds.

- Success tokens allow more flexibility for investors to negotiate terms with a DAO along with an increased likeliness of the deal being well received by decentralized communities.

Why Should DAOs Use Success Tokens?#

- DAOs should be happy to sell a call option because they are willing to sell their tokens at a higher valuation. Selling that optionality to the success token holder in return for downside protection is a great trade-off for the DAO.

- Success tokens allow DAOs to borrow funds without the risk of liquidation and utilizes their native token which dominates most of their treasury. In contrast, yield dollars and CDPs require borrowers to maintain a certain collateral ratio or face liquidation. Fighting against liquidation would be very detrimental for a DAO if the price of its native token drops aggressively and the DAO is forced to put a significant amount of its native token and treasury at risk.

- Success tokens can give the DAO access to VC capital and expertise which helps projects succeed without selling their tokens at a discount.