Mint and Farm YD-BTC-JUN21

This tutorial will show you how to leverage your BTC holdings to earn BAL and

UMA tokens.

Useful Links#

Step 1: Mint YD-BTC-JUN21#

You can now mint yield dollar tokens from two different interfaces.

Minting using EMP Tools#

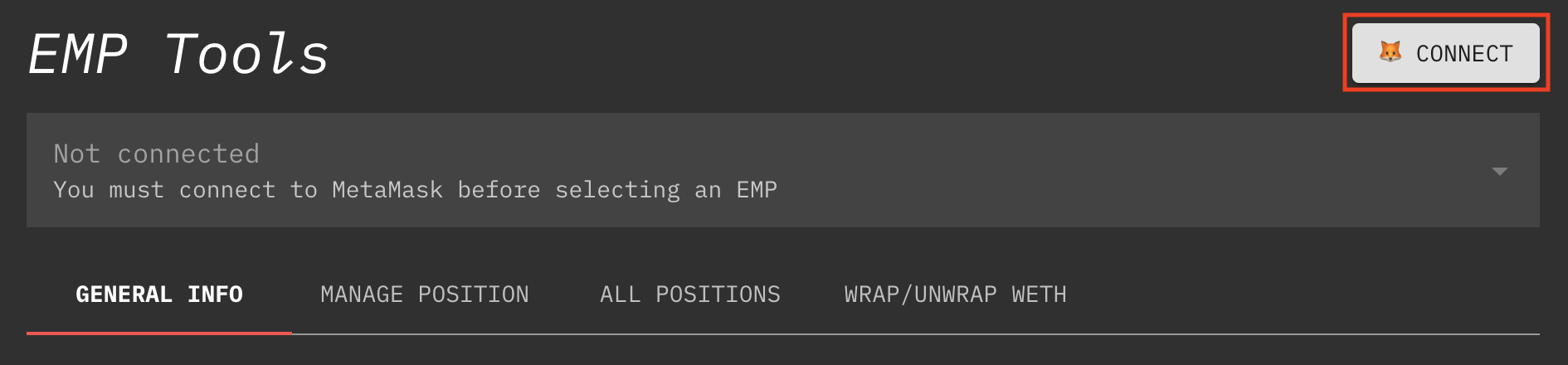

Navigate to http://tools.umaproject.org/ and click the "Connect" button at the top right corner to connect your MetaMask wallet to the dapp.

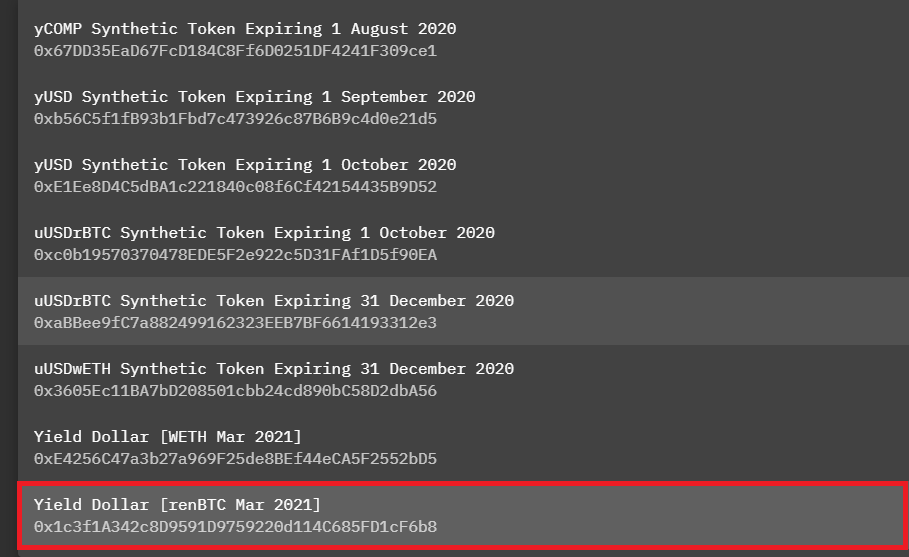

Then, select the YD-BTC-JUN21 contract from the dropdown immediately underneath the

header (above the tabs).

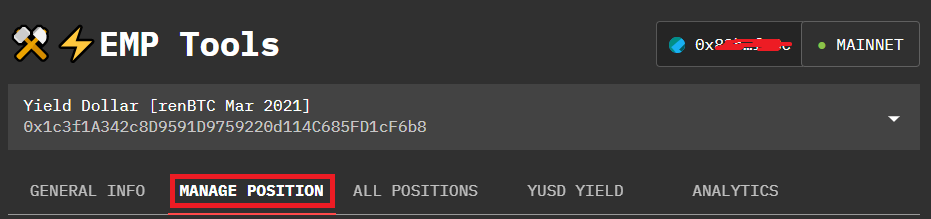

Select the "Manage Position" tab.

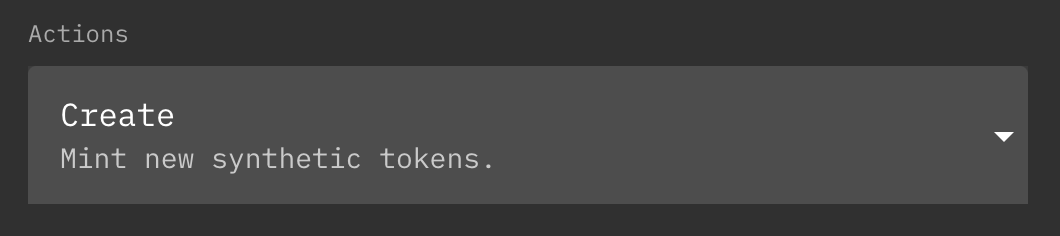

Scroll down to the "Actions" dropdown and ensure that "Create" is selected.

At this point, make sure you read the text and confirm that:

- You will be minting at a collateralization ratio above the global collateralization ratio (GCR);

- You will be minting the minimum required number of tokens (100 for

YD-BTC-JUN21), and; - You will keep your position collateralized above the minimum required

collateralization ratio (CR) or else risk getting liquidated (the required CR

is 125% for

YD-BTC-JUN21).

If you fully understand the above, and have decided on an appropriate amount of (1) collateral to supply and (2) tokens to mint, check to make sure you have enough collateral for minting.

In the case of YD-BTC-JUN21, the collateral you need is renBTC,

which is just BTC with an ERC20 interface. If you do not have a sufficient

balance of renBTC, you can easily convert your BTC to renBTC via Renproject's Bridge.

You may skip this step if you already have sufficient renBTC.

Once you have enough renBTC to use as collateral, return to the "Manage Position" tab and scroll down to the form at the bottom of the page:

In the first field, fill in the amount of collateral you want to supply.

In the second field, fill in the number of tokens you want to mint.

If these values are appropriate, you can then click the "Create" button which

will trigger a transaction with MetaMask. Once that is confirmed and the

transaction is mined, you shall have your YD-BTC-JUN21 tokens!

Minting using OpenDAO's Interface#

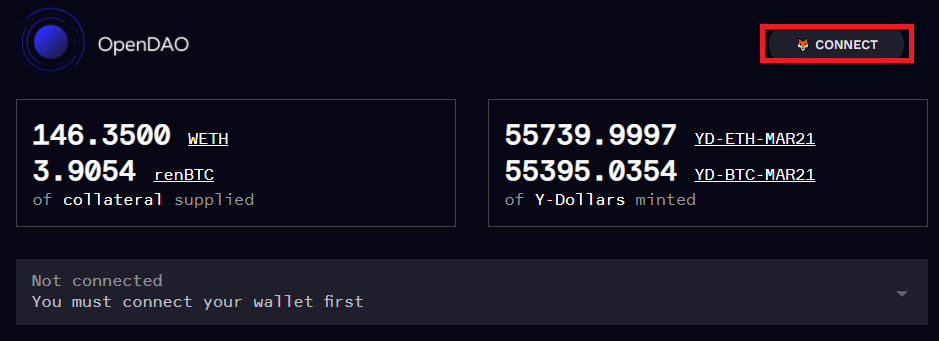

Navigate to https://ydollar.opendao.io/ and click the "Connect" button at the top right corner to connect your MetaMask wallet to the dapp.

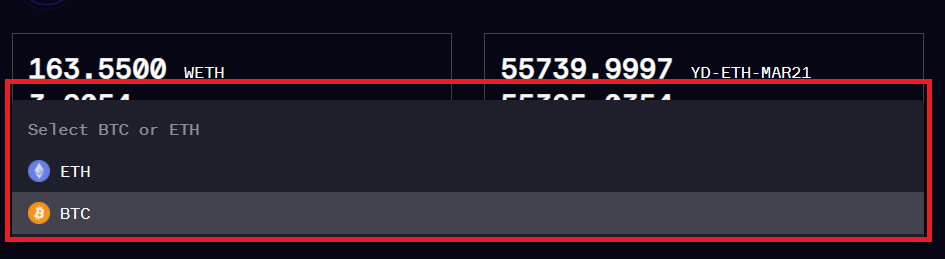

Then click select Btc or Eth and select the BTC(YD-BTC-JUN21) contract from the dropdown.

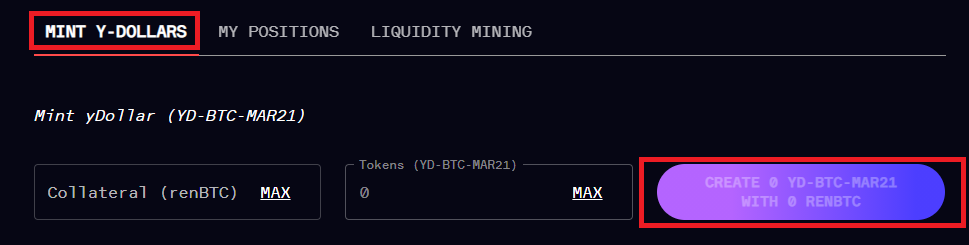

Select the "Mint Y-Dollars" tab.

At this point, make sure you confirm that you know that:

- You will be minting at a collateralization ratio above the global collateralization ratio (GCR);

- You will be minting the minimum required number of tokens (100 for

YD-BTC-JUN21), and; - You will keep your position collateralized above the minimum required

collateralization ratio (CR) or else risk getting liquidated (the required CR

is 125% for

YD-BTC-JUN21).

If you fully understand the above, and have decided on an appropriate amount of (1) collateral to supply and (2) tokens to mint, check to make sure you have enough collateral for minting.

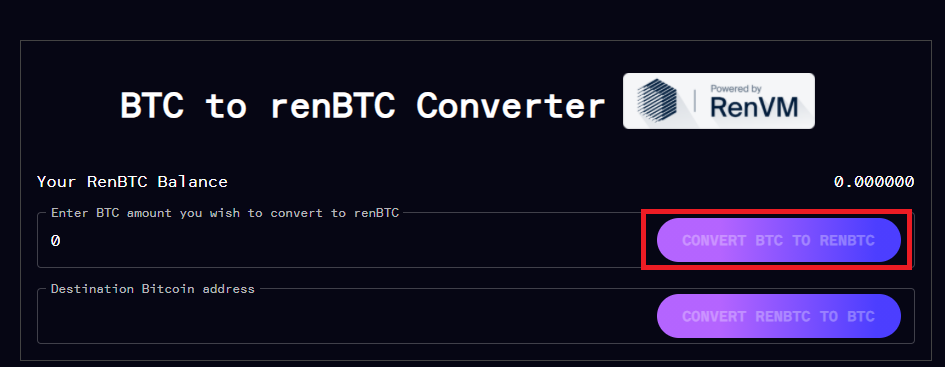

In the case of YD-BTC-JUN21, the collateral you need is renBTC,

which is just BTC with an ERC20 interface. If you do not have a sufficient

balance of renBTC, you can easily convert your BTC to renBTC via the BTC to renBTC converter.

You may skip this step if you already have sufficient renBTC.

Once you have enough renBTC to use as collateral, return to "Mint Y-Dollars".

In the first field, fill in the amount of collateral you want to supply.

In the second field, fill in the number of tokens you want to mint.

If these values are appropriate, you can then click the "Create" button which

will trigger a transaction with MetaMask. Once that is confirmed and the

transaction is mined, you shall have your YD-BTC-JUN21 tokens!

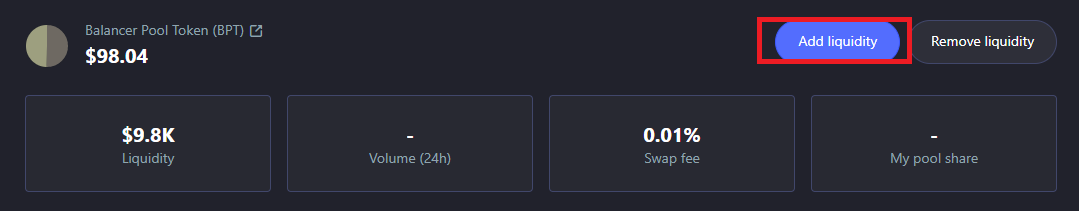

Step 2: Farm on Balancer#

danger

Supplying only USDC to the pool will result in auto-purchasing YD-BTC-JUN21 at the current price. This means you are market-buying YD-BTC-JUN21, so be mindful of the trading price of YD-BTC-JUN21 before doing this.

By supplying liquidity to the YD-BTC-JUN21 Balancer pool, you have the

opportunity to earn both BAL and UMA tokens.

Head to the YD-BTC-JUN21

pool

and click on the "Add Liquidity" button. You’ll be asked to Setup Proxy if you

haven’t already

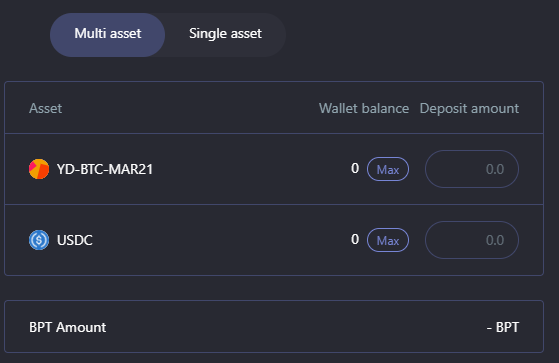

Once the proxy is setup, the "Add Liquidity" button will show you a form for adding liquidity.

At this point, you might want to get some USDC so you can supply both assets

to the Balancer pool. Alternatively, Balancer also supports supplying only a

single-asset but that mechanism is out of scope for this tutorial.

Under the "All Pool Assets" tab, you should see something like this:

As with any other ERC20 token, you'll have to "unlock" (i.e. grant approval) for

the dapp to transfer tokens on your behalf. Once you have done that, you can

deposit YD-BTC-JUN21 and USDC into the Balancer pool in exchange for some Balancer

Pool Tokens (i.e. BPT) specific to this pool.

This enables you to passively gain BAL as well as UMA. If you have any questions regarding

this process, please don't hesitate to reach out on

Discord.